Through a differentiated mechanism of action, the DPX platform delivers instruction to the immune system to generate a specific, robust, and persistent immune response. is a clinical-stage immuno-oncology company advancing a portfolio of therapies based on the Company’s immune-educating platform: the DPX® technology. This press release shall not constitute an offer to sell, or the solicitation of an offer to buy, nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. Securities Act and all applicable state securities laws, or compliance with an exemption from such registration requirements. Securities Act) absent registration under the U.S.

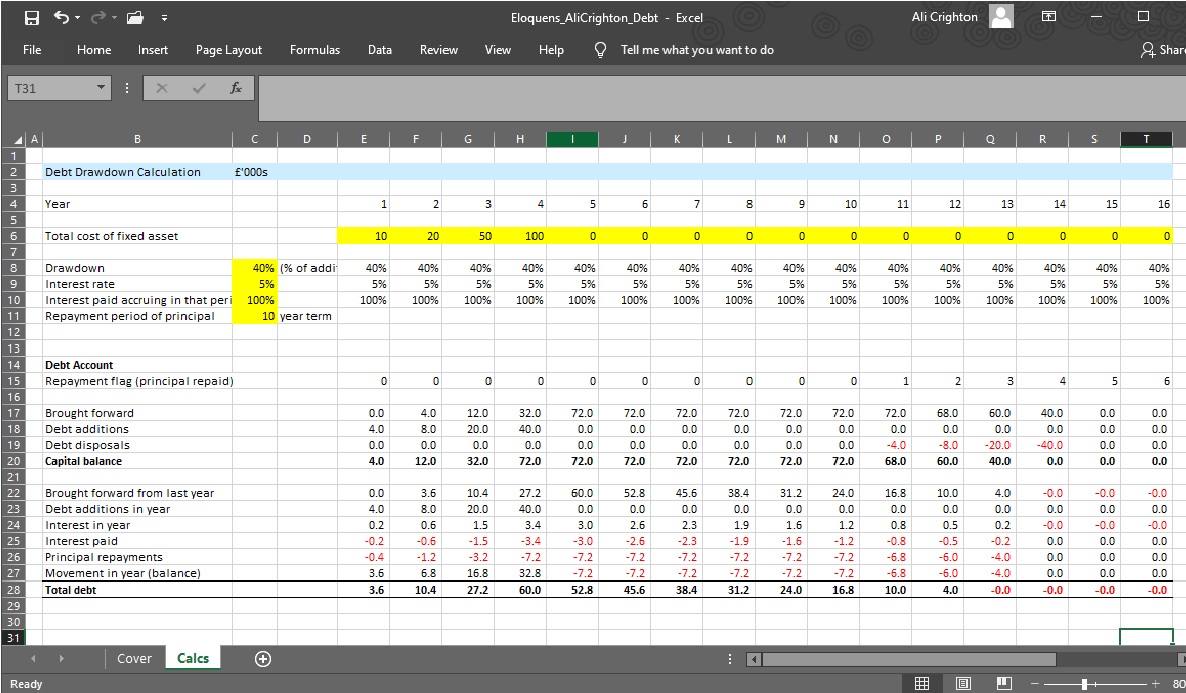

persons (as such term is defined in Regulation S under the U.S. Securities Act"), or any state securities laws, and may not be offered or sold to, or for the account or benefit of, persons in the United States or U.S. Securities Act of 1933, as amended (the "U.S. The securities offered have not been and will not be registered under the U.S. For the purpose of Toronto Stock Exchange ("TSX") approval, the Company is relying on the exemption set forth in Section 602.1 of the TSX Company Manual, which provides that the TSX will not apply its standards to certain transactions involving eligible interlisted issuers on a recognized exchange, such as NASDAQ, provided that the transaction is being completed in compliance with the requirements of such other recognized exchange. The Loan Warrants and the Shares issuable upon exercise thereof will be subject to a statutory hold period of four months following the issuance of the Loan Warrants in accordance with applicable securities laws. 454,544 Loan Warrants were issued on December 17, 2021, and the balance of 113,636 Loan Warrants have been issued in connection with the drawdown of the additional US$10 million available under this facility. In connection with this financing, IMV has agreed to issue warrants (the "Loan Warrants") to purchase up to 568,180 common shares of the Company (the "Shares") at an exercise price of US$1.32 per Share until December 17, 2031. It provides operating cash into the second quarter of 2023, as per our current business plan, to continue to advance the development of our lead compound in Diffuse Large B-Cell Lymphoma (DLBCL) and ovarian cancer, while building incremental value through our DPX technology platform." "Our balance sheet has been strengthened by this debt facility. "The execution of our clinical team to launch the AVALON trial has permitted us to access this capital in a timely manner," said Andrew Hall, Chief Executive Officer of IMV.

This drawdown has been made available as the Company achieved a predetermined milestone following site activation in its Phase 2b AVALON trial in platinum-resistant ovarian cancer. (NASDAQ: IMV TSX: IMV), a clinical-stage company developing a portfolio of immune-educating therapies based on its novel DPX ® platform to treat solid and hematologic cancers, today announced the drawdown of the remaining US$10 million available under its existing US$25 million debt facility led by Horizon Technology Finance Corporation (Nasdaq: HRZN) ("Horizon"). Phase 2b AVALON trial in platinum-resistant ovarian cancer open for enrollmentĭARTMOUTH, Nova Scotia & CAMBRIDGE, Mass., June 22, 2022-( BUSINESS WIRE)-IMV Inc. IMV achieves predetermined milestone to access the remaining $US10 Million under its Debt Facility with Horizon

0 kommentar(er)

0 kommentar(er)